虎年快乐

Hehe, evo prijevoda, malo mi je zahrđao kineski, ali google translator još radi

:

虎年快乐

"happy tiger year"

Bolje bi bilo da si mi na slovenskom napisao ![]()

虎年快乐

Hehe, evo prijevoda, malo mi je zahrđao kineski, ali google translator još radi

:

虎年快乐

"happy tiger year"

Bolje bi bilo da si mi na slovenskom napisao ![]()

BCI 5 T/C routes 180000 10753 738

BPI 5 T/C routes 82500 16296 -158

BSI 10 T/C routes 58328 17354 -107

BHSI 7 T/C routes 38200 17914 -131

BDI INDEX 1440 +22

Po mom izračunu u razlici operativnih dana za Q3 u odnosu na H1 fale 4 broda odnosno 18,5 dana prosjecno na 4 broda sto je vremenski opravdano za relokaciju po brodu.

18,5 dana izgubljenih na putovanje u Q3 mi

daje osobnu procjenu mogucnosti da je vecina potpisala ugovore u cca10.mj. nadam se na trajanje od 12 mjeseci.

Necemo se žaliti ni na 9-ti i 11-ti mjesec sve su to lipi prosjeci vozarina.

Još su nam se dva sakrila?

(Postoji mogucnost da su prvi krenili krajem 2Q??)

Za Q3 mi (uz lošiju uposlenost flote) ispada prosjek za smax i hsize 17 448$

(Danasnje razine)

Ako su ostala dva obnovili ugovore u Q4 imamo Q1/22 bolji od Q4/21koji će biti top.

Bolje vozarine+ bolja uposlenost 3-6%(grah)

Ne zaboravimo koliko će nam postepeno smanjenje dugovanja povećavati prinose.

(rate+kamate)

Dokovanja se moraju dogoditi i tog se ne tiba strasiti (štednja u budućnosti).

Raspodjelom troskova dokovanja na godišnje troskove usudio bi se reći da će

Q2/22 biti bolji od Q1/22

te Q3/22 od Q2/22…. malo ulja na vatru 😁

Pratimo razvoj situacije....većina je očekivala pad u ovo doba godine...ali burza obično iznenadi.

Vrlo zanimljiv intervju s Petrosom Pappasom. CEO Star bulk. https://seekingalpha.com/article/448292…on-and-shipping

Chinese cement production

Peristil (JDPL ) , AP Dubrava i AP Revelin https://ultrabulk.com/fleet/

AP Slano i AP Ston https://www.hbc-hamburg.com/mobile/index.php?id=181&language=4

Treba malo provjeriti ovaj podatak, dobit Q4 i Q1 bi onda bila osjetno veca od ocekivanja, mojih a i vasih koliko sam citao. Vidim da se i na drugom forumu uhvatio taj podatak.

Vani lijep rast...sutra bi moglo bit živo i kod nas😀

Chinese cement production

The content cannot be displayed because you do not have authorisation to view this content.

Primjetili ste potencijal rasta vozarina kada cement krene?

mislite da nece krenuti?

Chinese cement production

The content cannot be displayed because you do not have authorisation to view this content. Primjetili ste potencijal rasta vozarina kada cement krene?

mislite da nece krenuti?

Cak i po obliku grafa izgledno je da slijedi nagli rast odnosno preokret prema gore.

Evo malo updatea orderbooka i port congestiona

i za kratkovidne i za dalekovidne pa kako tko tumači ![]()

![]()

![]()

Primjetili ste potencijal rasta vozarina kada cement krene?

mislite da nece krenuti?

Cak i po obliku grafa izgledno je da slijedi nagli rast odnosno preokret prema gore.

Pad je sezonski+pojacani

CCP je vec odrijesio kesu i opet ce prije nego se ovih 188 milijardi$ potrosi.

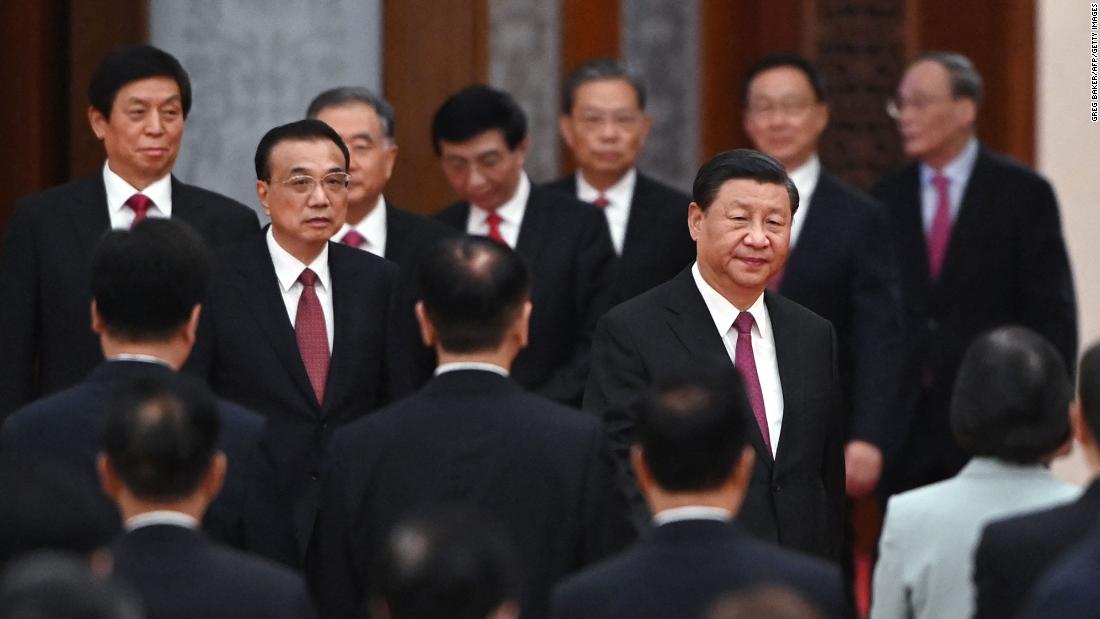

Krajem ove godine jako vazan event

Drug Xi ide po jos jedan mandat.

Sapienti sat.

🇨🇳Drugovi i drugarice ce se jako potruditi da isporuce rezultat za tako vazan event.

Nakon olimpijade treba ocekivati veliku gospodarsku aktivnost da se podigne slabi rast GDP.

We have revised target prices...

I to na vise zanimljivo

I to na vise zanimljivo

Uračunali su inflaciju

BCI 5 T/C routes 180000 10616 -137

BPI 5 T/C routes 82500 15885 -411

BSI 10 T/C routes 58328 17273 -81

BHSI 7 T/C routes 38200 17817 -97

BDI 1419 -21

Netko je spominio GRIN-a evo jedan friskiji osvrt na njega i neke druge mozda bude kome zanimljivo iako je noviji autor pa pitanje koliko je vjerodostojan

https://seekingalpha.com/article/4483071-grindrod-shipping-stock-buy-worth-23

Mainland Chinese key dry bulk commodities fundamental demand is projected to stable in 2022

With the continuing COVID-19 pandemic and the 2022 Winter Olympics dampening the economy development, mainland China's GDP growth in the fourth quarter 2021 was 4%, which is lower than the 4.9% growth recorded in the previous quarter and 6.5% lower than the growth recorded in the corresponding period a year earlier. The National Bureau of Statistics said mainland China's GDP grew 8.1% in 2021, partly owing to the low base growth of only 2.2% in 2020. IHS Markit forecasts mainland China's GDP growth for 2022 will be 5.4%. Economic policy will change in 2022 to encourage growth in reaction to the slowdown. Mainland China's economy is faces challenges from COVID-19 outbreaks that are weighing on consumption and the property market downturn. Mainland China needs more stimulus in 2022 to sustain its economic recovery. Earlier this week, IHS Markit observed the government announcing monetary stimulus and a decrease in the Loan Prime Rate to help the struggling property industry.

As economic growth is highly correlated with dry bulk freight rate, and with the government aiming for a stable GDP growth in 2022, the dry bulk industry can be expected to gain momentum and improve towards the end of this quarter.

Mainland China's steel output has been reduced to realize the government's 'blue sky' goal for the Winter Olympics that are set to open in February 2022; Chinese steel production hub Tangshan has issued orange alerts several times in the winter to combat heavy pollution. Steel mills were forced to curb output until further notice. Dropping steel output weakened demand for raw material — iron ore. According to IHS Markit's Commodities at Sea data, total iron ore shipment arrivals to mainland China in 2021 were down 2.8% year on year (y/y) from the record high levels in 2020 although Chinese iron ore imports marginally increased 3% month on month (m/m) in December 2021 with winter restocking demand.

After bottoming out in mid-November 2021, iron ore prices were back above $130 per metric ton (62% CFR Qingdao), hoping for the mainland Chinese government's stimulus package for the property sector amid ongoing concerns about supply disruptions in Australia and Brazil. Minor adjustment on iron ore prices is within expectation when traders become more cautious considering the approaching Chinese New Year and Winter Olympics. However, economic growth will be essential for mainland China in 2022 as the National People's Congress (NPC) and the Chinese People's Political Consultative Conference (CPPCC) will be held this year. Thus in the medium-term point of view for the entire 2022, IHS Markit believes mainland China's iron ore imports will be supported at least until the third quarter of 2022

Evo šta kaže Mintzmyer

Jucer su strani bulkeri ostali oko nule ali su zadrzali veliki rast od dan ranije a danas vikinzi od jutra jurisaju.

Futuresi su okrenuli u veci plus jucer, danas nastavak rasta.

Znam da vodeci tehnicari cekaju ispod 350 i da prvo ide olimp pa sam zatecena 🤪

Dali i atpl ide na taj olimp? ![]()

![]()

![]()