BCI 5TC 30972 +712

DRY BULK

-

-

-

BCI 5 T/C routes 180000 30972 712

BPI 5 T/C routes 82500 36912 -240

BSI 10 T/C routes 58328 31798 -74

BHSI 7 T/C routes 38200 29720 255BDI Index 3300 +19

-

Orderbook za cape-ove je trenutno navodno najniži u povijesti.

Current orderbook:

Capesize: 5.9%

Panamax: 6.15%

We are now at levels for Capesize not seen since EVER (my data goes back to 1996).

-

Ovako izgleda za flotu, trend je za sada stabilan

-

https://www.hellenicshippingnews.com/no-letup-yet-i…markable-rally/

“We believe a perfect storm of underlying supply and demand fundamentals is shaping up in the dry bulk segment, which could boost charter rates and asset values in the coming years,”

-

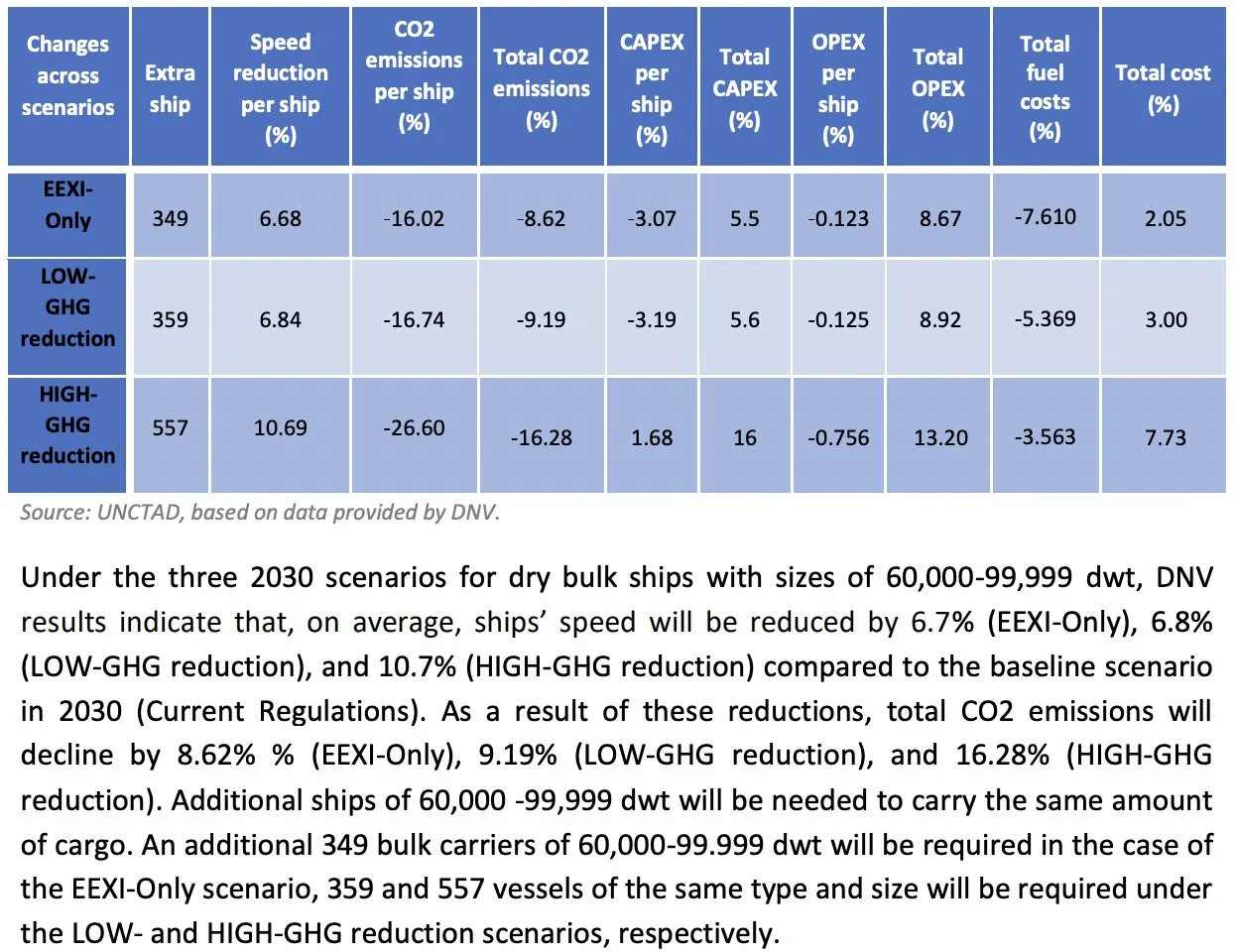

Još malo vezano za EEXI i procjenu usporavanja flote do 2030.

Even with the very weak current IMO regulations, UNCTAD expects the fleet to slow by 6.7% this decade. An extra ~1% of new ship capacity per year will be needed to offset in addition to ~2% per year to replace old ships. Compare this to a drybulk orderbook of just 5.6% today.

-

Još malo vezano za EEXI i procjenu usporavanja flote do 2030.

Even with the very weak current IMO regulations, UNCTAD expects the fleet to slow by 6.7% this decade. An extra ~1% of new ship capacity per year will be needed to offset in addition to ~2% per year to replace old ships. Compare this to a drybulk orderbook of just 5.6% today.

Prenosim razmisljanje jednog analiticara:

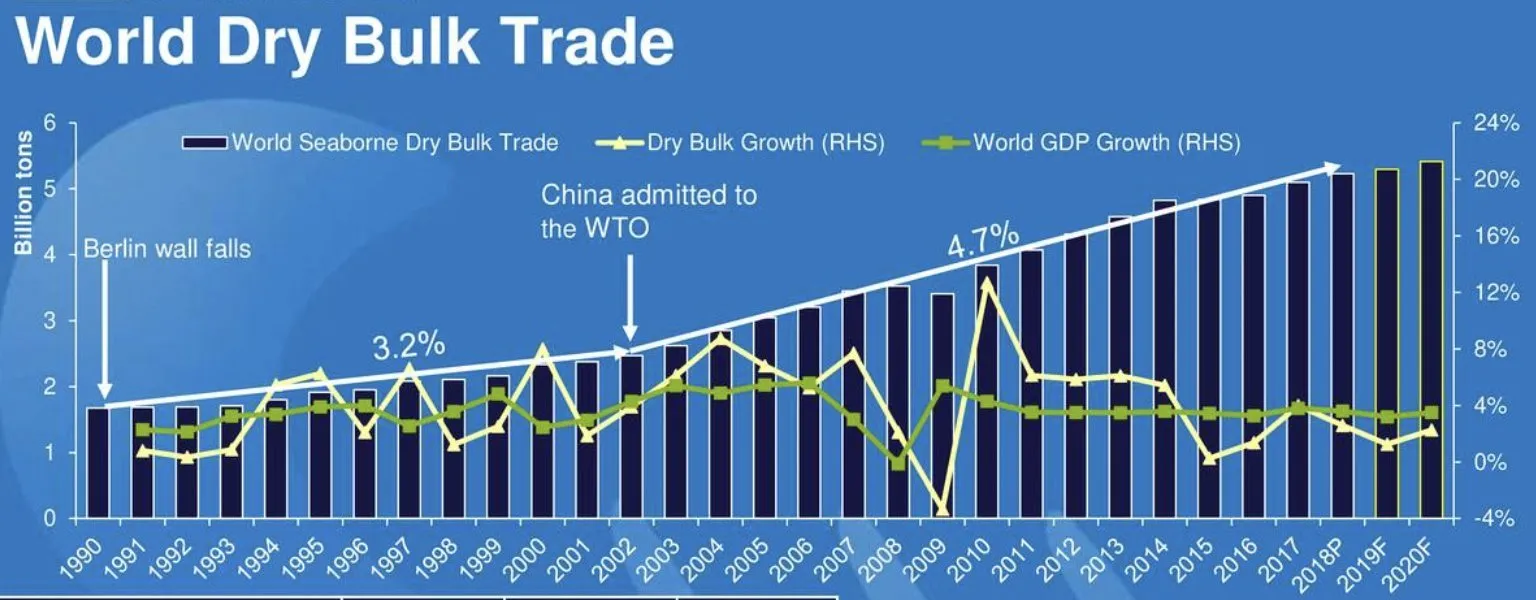

Drybulk demand grew at a CAGR of 4.7% per year since China was admitted to the WTO. Even if this slows SIGNIFICANTLY to 2.5%, this means to maintain the very tight supply/demand balance we see today, we will need 5%+ of new ship capacity to deliver each year this decade.

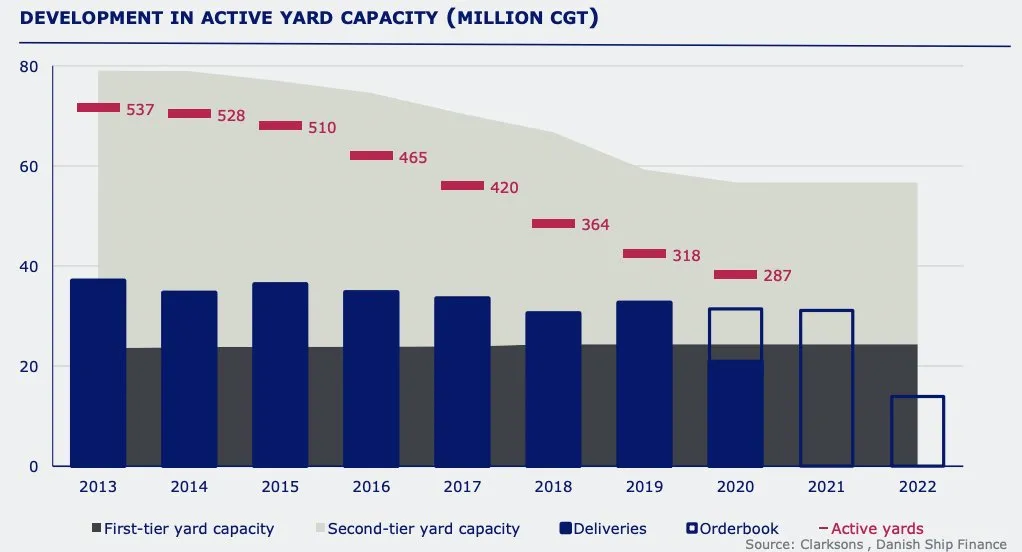

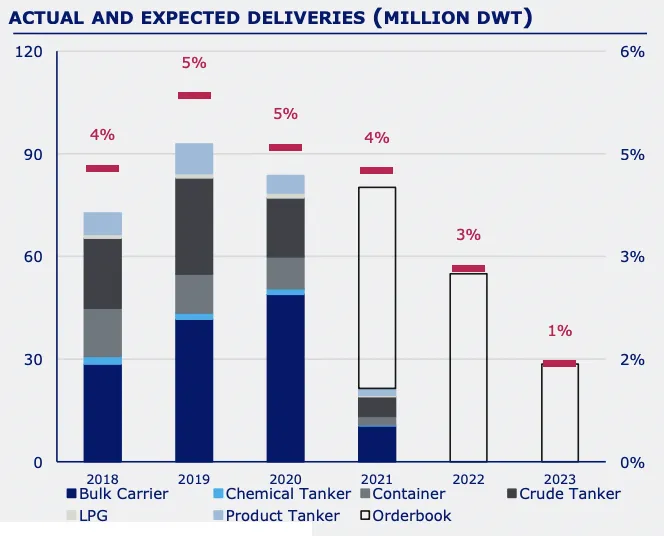

In DWT (capacity terms) this 5%+ per year of new ships needed is equivalent to ~50M DWT. This is more ship capacity than has been built in each of the past 8 years. Although not a problem in isolation, shipyards are already full through 2023 ships from other fast growing sectors.

Over the same 8 year period shipbuilding capacity has actually been contracting and expected to contract further. All other sectors will need the same extra ~1% of new capacity per year to offset slow steaming and shipbuilding capacity is already sold out before this effect.

With shipbuilding capacity for large ships sold out through 2023 despite one of the lowest cross-sector orderbooks in history on a percentage basis of the global fleet, it is clear that shipbuilding capacity will be grossly insufficient by 2024.

Despite persistently high rates in the last cycle starting in 2003, it took many years to build enough shipbuilding capacity and then many more years to build enough ships to meet demand leading to a 7 year period of very high drybulk shipping profits.

Although every cycle is different and this is NOT the last cycle, many of the same forces are at work. I expect an extended period of high profitability as forces constraining supply will cause supply to consistently lag demand making shipping a top performer in the coming years.

-

https://www.hellenicshippingnews.com/no-letup-yet-i…markable-rally/

Zanimljiv clanak posebno detalj o porastu cijene brodova

-

I nasi dnevni portali su poceli pisati o rastu brodarskih dionica na burzi.

Brodarske kompanije lani grebale po dnu, a ove godine njihove su dionice pravi burzovni hit

-

BCI 5 T/C routes 180000 31266 294

BPI 5 T/C routes 82500 36626 -286

BSI 10 T/C routes 58328 31702 -96

BHSI 7 T/C routes 38200 29735 15

BDI Index 3300 flat

Freight futures am update

Capesize down ~2%

Panamax down ~1%

-

-

I nasi dnevni portali su poceli pisati o rastu brodarskih dionica na burzi.

Brodarske kompanije lani grebale po dnu, a ove godine njihove su dionice pravi burzovni hit

dobra reklama, ove brojke i postoci vrijede više nego svi postovi na forumu, koje nitko nije vidio od onih što štede u bankama, ovo ipak djeluje razumljivo i jasnije

-

Ma nema pomame na zse u nicemu. To vam je kao sa turizmom svatko je u to krenio kad je doslo na vrhunac, tako ocekujte sa brodarima kad mi krenemo izlazit na xxxx dragi citaoci ce pocet ulazit jer ce o tome citat u slobodnoj i indexu. Strpljivo

-

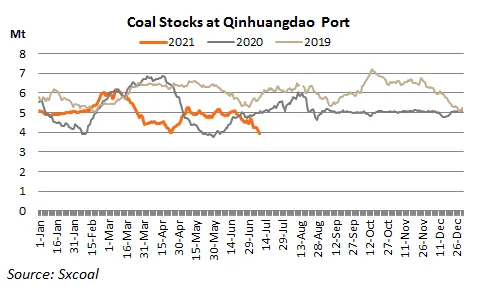

Zalihe ugljena su jako nisko, i to sve usred toplinskog vala. Izgleda da nam uskoro slijedi još jedan nagli skok potražnje za ugljenom.

Coal stocks slumped below 4 Mt at Qinhuangdao port, a major thermal coal transfer hub in northern China, as long-term contract deliveries gained strength in the week ending on Jul 9.

-

Kalkuliraju zbog visokih vozarina.. pa kad bude da nema čekanja, bit će veselo

-

bdi i vozarine danas?.....imal' tko?.....

-

bdi i vozarine danas?.....imal' tko?.....

Route Description Size Value ($) Change

BCI 5 T/C routes 180000 30272 -994

BPI 5 T/C routes 82500 35734 -892

BSI 10 T/C routes 58328 31512 -190

BHSI 7 T/C routes 38200 29881 146BDI INDEX 3228 -72

-

SENTIMENT DEFINES SHIPPING

https://www.breakwaveadvisors.com/insights/2021/…behind-shipping

-

-

A ništa, kupi jedan brod i s njim u garažu. Prodaš ga iduće godine po duplo višoj cijeni. 🙂

-

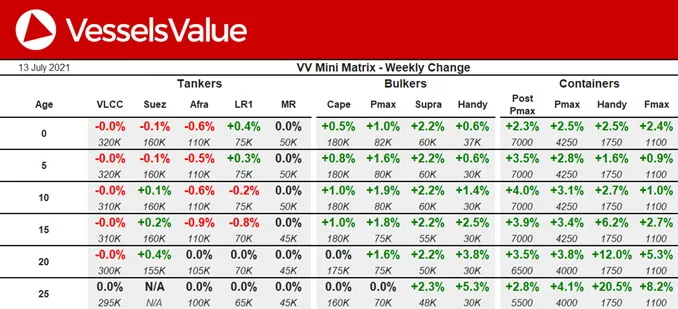

Pa sad kad vec pitate...ako pogledate skroz desno vidite da nesto raste i vise od 2% tjedno a to su kontejnerasi. Onda pogledamo njihove relevantne indekse i vidimo da su na ath, rastu iz tjedna u tjedan do razina da nas bdi izgleda smijesan a recimo da (neke) dionice to bas i nisu popratile

-

-

Nepročitani postovi

-

- Title

- Odgovora

- Zadnji odgovor

-

-

-

DLKV (Dalekovod d.d.) 3.2k

- harpun

March 11, 2026 at 2:05 PM

-

- Odgovora

- 3.2k

- Pregleda

- 1.5M

3.2k

-

-

-

-

HPB (Hrvatska poštanska banka d.d.) 3.2k

- harpun

March 11, 2026 at 10:31 AM

-

- Odgovora

- 3.2k

- Pregleda

- 1.2M

3.2k

-

-

-

-

MDKA (Medika d.d.) 923

- harpun

March 10, 2026 at 8:45 PM

-

- Odgovora

- 923

- Pregleda

- 371k

923

-

-

-

-

VLEN (Viktor Lenac d.d.) 2.2k

- accountant

February 14, 2020 at 12:36 PM - Dionice

- accountant

March 10, 2026 at 7:20 PM

-

- Odgovora

- 2.2k

- Pregleda

- 1.1M

2.2k

-

-

-

-

JDGT (Jadroagent d.d.) 244

- harpun

March 9, 2026 at 7:41 PM

-

- Odgovora

- 244

- Pregleda

- 111k

244

-